Did you know that 9 out of 10 millionaires get rich from real estate? And the reason is not far-fetched. Real estate investment is one of the earlier and most stable forms of investment since you can make money in multiple ways, including house flipping and renting out. Yes, it has its ups and downs, however, you can’t compare a stock market crash to a real estate crash. That’s why we want you to consider investing in the Ottawa housing market!

What attracts investors to the Ottawa housing market?

The Ottawa housing market provides a stable opportunity to any investor, no matter your experience. The city offers a high quality of life and a fantastic opportunity for education and long-term employment alike. Ottawa appeals to young professionals in all fields including government, education, healthcare and the tech industry (with Ottawa being “Silicon Valley North”). And with so many young professionals, the rental market provides ample opportunities for investors like yourself to find ideal tenants.

With an unemployment rate of just 4.7%, Ottawa is higher than the Canadian average at 5.7%. And with a median household income of $102,000, there are plenty of opportunities for tenants with a consistent and reliable income. Additionally, Ottawa is one of Canada’s safest cities with a crime rate of 4,019 and a crime severity index of only 52.9. This is far below the national averages of 5,668 and 78.1 respectively. These statistics further demonstrate the economic stability and safety in Ottawa.

What does the Ottawa housing market look like?

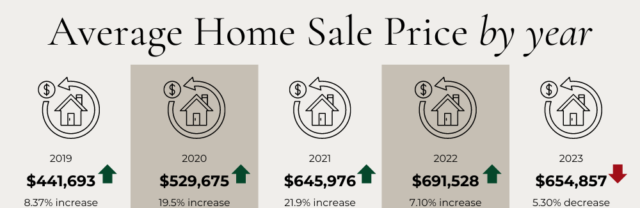

The city offers a variety of housing styles, from traditional single-family homes and bungalows to modern townhomes and row units. You can certainly find something to meet your needs. Another compelling factor contributing to Ottawa’s appeal is the city’s remarkable real estate appreciation rate. Ottawa’s real estate market has experienced consistent and rapid appreciation, making it an ideal destination for potential homebuyers and investors alike.

Over the past several years, property values in Ottawa have shown a notable upward trend, outpacing the national average. As a result, investing in real estate in Ottawa not only provides you with a place to call home but also offers the potential for substantial financial growth. Whether you’re eyeing a long-term residence or a lucrative investment opportunity, Ottawa’s housing market stands out as an ideal choice. This ensures your property holds and increases its value over time. Stay ahead of the curve and capitalize on Ottawa’s flourishing real estate market for a wise and rewarding investment.

Opportunity to invest no matter your risk-tolerance level

Ottawa provides an opportunity to own a low-maintenance property while continuing to diversify your real estate portfolio. Due to the lower entrance barrier and stable economy, investing in Ottawa’s housing market is not as financially risky as other Canadian cities. If you are a risk-tolerant investor, you maintain a range of opportunities in the Ottawa housing market. However, if you are a risk-averse investor, you can focus on low-maintenance properties such as turn-key condos. Should you want to increase your tolerance level, you can diversify your portfolio while continuing to mitigate risk.

Real estate is a tangible asset. And the housing market in Ottawa favours investing in real estate far more than in other Canadian cities. Because the economy in Ottawa remains relatively stable, you can quickly begin to grow your portfolio and start generating cash flow.

Low foreclosure and vacancy rates

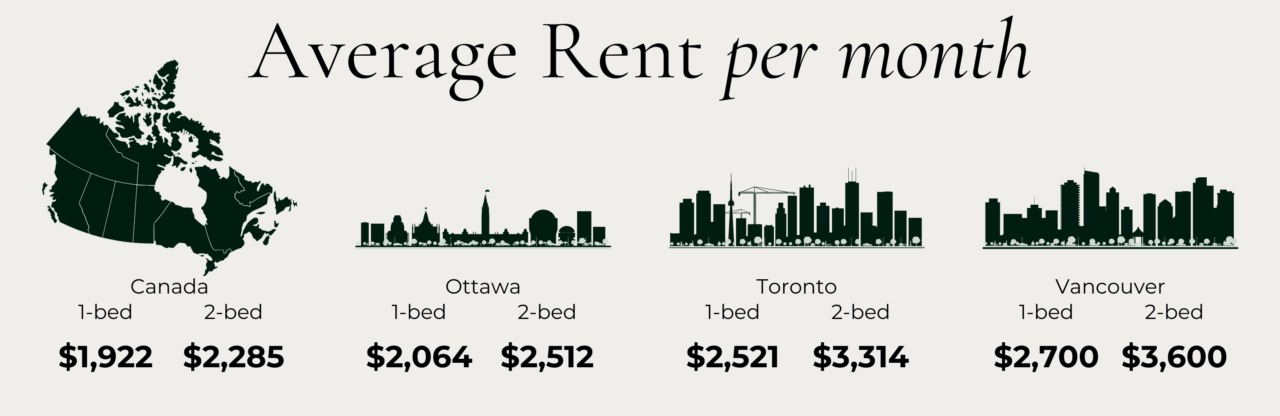

Another good reason you should invest in the Ottawa housing market is the low foreclosure and vacancy rates.. This means more people are looking for properties to buy or rent. And as the median household income is higher, tenants can afford to rent reliably. Additionally, with the presence of major universities and colleges, national and international employers, and foreign embassies bringing people to Ottawa every day, people are always looking to rent in Ottawa at a large range of price points.

Things to think about before investing

Before we dive in further, it is important to ask yourself a few questions:

- When investing in one particular property, what are the costs and what are the benefits?

- Does this property have any special features that would help to attract renters such as building amenities, storage space or covered parking?

- How do the costs and benefits of one particular property compare to other similar properties?

- What is the real market value of this home (not the asking price)?

- What would my mortgage payments be on this home? (You can use our Mortgage Calculator tool here to estimate your monthly costs).

- How much can I rent this property out for?

Oftentimes, first-time investors will purchase a property with the plan of renting it out. But they do not take into consideration the carrying costs and whether or not the property will actually generate cash flow if it is rented out. Analyzing the listings that you are looking at can be a good way to quickly decipher which homes stand out as good investments. It is important to consider your monthly costs for the property and compare this to how much it will potentially be rented out for. We do not say this to scare you away, but to provide further insight as to what you should expect from your investment property. Hopefully, this will provide some guidance when looking at the following statistics. Remember, don’t get stuck on the numbers. Think about the long-term investment you are making.

What does it cost to buy in Ottawa?

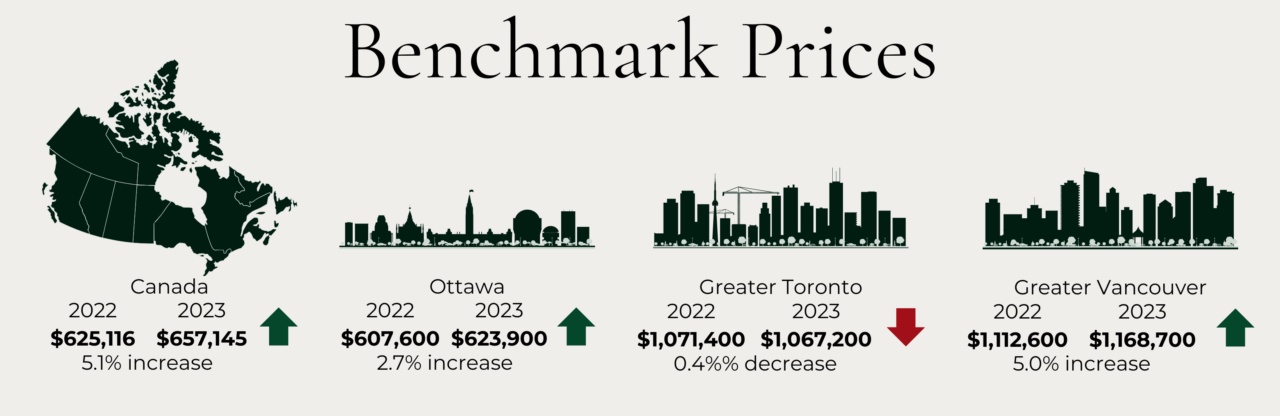

The best way to look at this information is as a whole. Like any market, the housing market ebbs and flows. There are highs and lows. That said, the Ottawa housing market remains a better investment opportunity than most other Canadian cities. The Canadian Real Estate Association (CREA) observed a national benchmark price is 5.18% higher than the benchmark price in Ottawa. This confirms why Ottawa is still one of the best major cities in Canada to invest in. By comparison, the benchmark price in Greater Toronto is 52.34% greater and in Greater Vancouver is 60.82% greater. This demonstrates the affordability of the Ottawa housing market for buyers.

What does this mean for my investment?

Of course, when considering an investment it’s important to think about what you’ll be getting in return. According to Rentals.ca, Ottawa was the eleventh most expensive city in Canada to rent in for February 2024. While Ottawa remains one of Canada’s more affordable major cities to buy in, the rental market remains relatively competitive. With the current rental rates, Ottawa rents approximately 20-35% lower than Toronto and Vancouver. However, it is 50-60% more expensive to buy in.

Conclusion

Even though Ottawa is the country’s capital, the city is still developing, which presents a lifetime opportunity for you to invest. As we’ve discussed, Ottawa offers a comfortable, high-quality life to a range of residents from students to young professionals to growing families. There are also a lot of trendy yet affordable neighbourhoods within the city. Investing in areas close to the LRT, universities and colleges, and high-traffic areas will be to your advantage as these areas have a high demand for many different demographics. These factors contribute to the large number of prospective tenants with a reliable income, perfect for an investor like yourself.

Secondly, the Ottawa housing market provides a low entry barrier, lower downpayment expectations, opportunity for a range of risk-tolerance levels, and low foreclosure and vacancy rates compared to other Canadian cities. Additionally, the cost of an investment property in Ottawa is far lower than in other cities. These factors further the investment opportunity regardless of your existing portfolio.

I also recommend investing in areas going through a growth phase or renewal like Overbrook and Bells Corners, and in the regions that are constantly stable, like Centretown. You can also get insights on areas to invest in by following where the big property builders are, like current developments in Barrhaven and Kanata.

With many places in the city slowly developing, surely, you will be able to buy a standard home with a lower down payment and a low price and see its value increase in a short time. Do you need help with which neighbourhood holds the most value to invest in in Ottawa? Whether you’re a first-time or seasoned investor, the Ottawa housing market has something for you. And as an award-winning REALTOR® with years of experience working in the Ottawa housing market, I can help make investing here seamless.

Looking to get started? Reach out - I'd love to chat about your real estate goals!

Having both personally invested in the Ottawa housing market as well as working with many investors as an Agent, I’ve likely come across a situation similar to yours and am always happy to discuss. You can reach me by filling out the contact form below, at (613) 875-2225, or by emailing me directly at shaunnamcintosh@royallepage.ca. We also offer quarterly newsletters so let me know what information you’re looking for, and I’ll get you set up to receive the most pertinent information for your situation. I look forward to hearing from you!